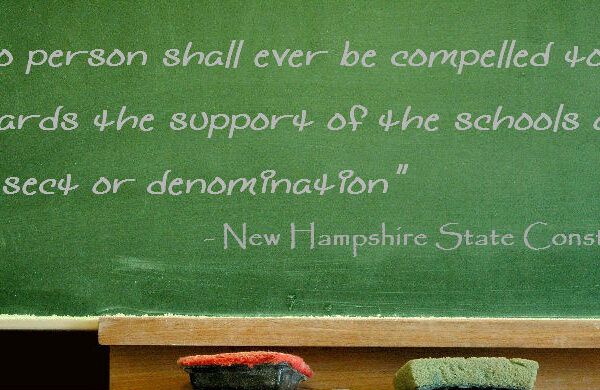

The NHCLU, in partnership with the Americans United for Separation of Church and State and the national ACLU offices, filed suit on January 9th, 2013, challenging a statewide tuition tax credit program that would divert taxpayer funds to private religious schools.

The Education Tax Credit Program allows businesses to reduce their tax liability by receiving an 85 percent tax credit in exchange for donations made to K-12 scholarship organizations, which will pay for tuition at religious and other private schools. Since there is no state oversight of the schools receiving funds, religious schools will be able to use the donations for religious instruction, indoctrination and religiously based discrimination.

To find out more,

click here to read the Press Release.

To read the complaint,

Click here to read more about Religion in Schools.